Index Returns

Why Higher Returns May Be Achievable

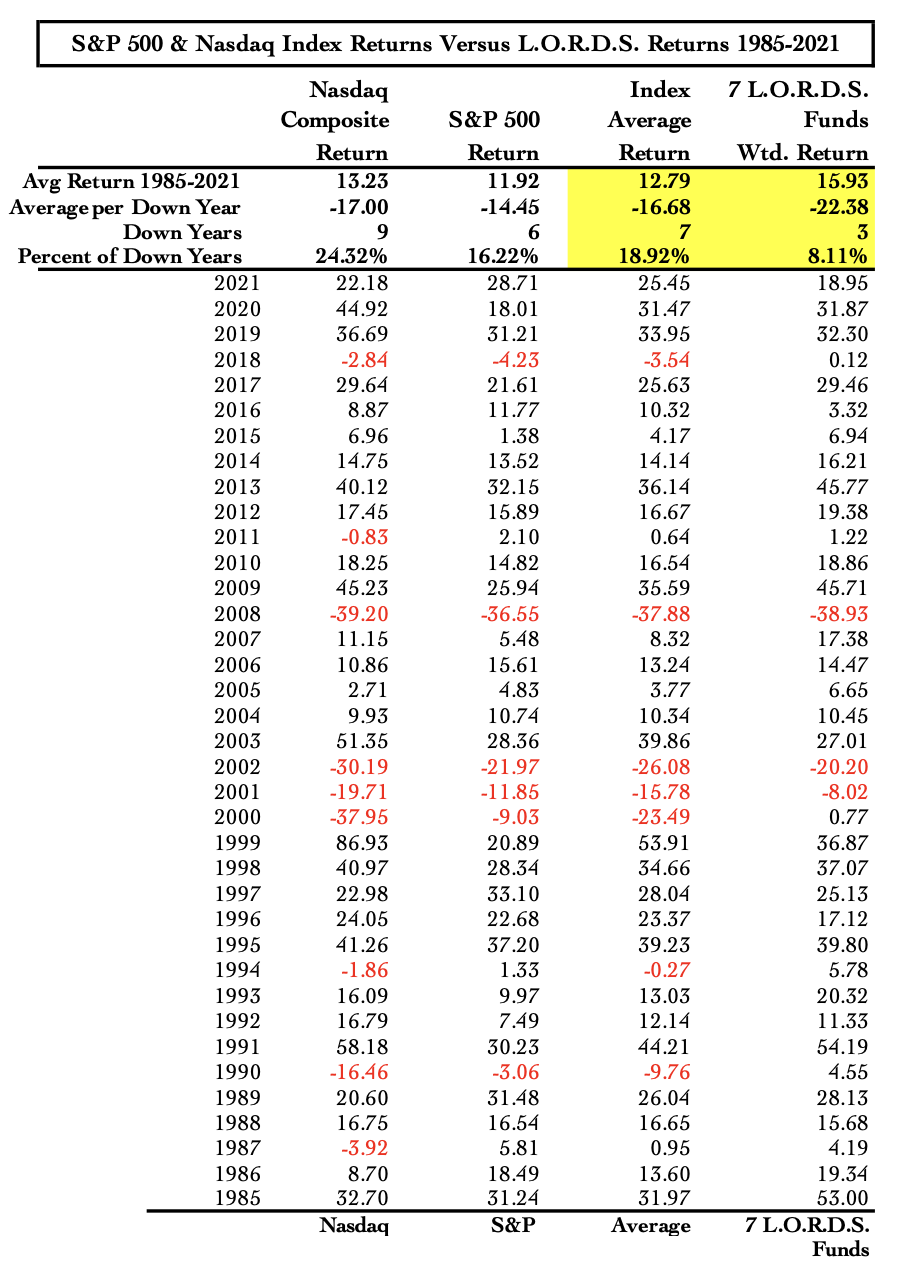

Our objective is maximize returns by investing into higher returning Nasdaq stock funds. We attempt to limit our downside exposure by diversifying across specific sectors in different industries. Therefore, our performance does not necessarily follow the market’s, as you can see in the chart below. Since 1985, our mutual funds have averaged less than half of the down years, have only gone down 5.6% more during the average down year and have returned 3.13% more than the average of the Nasdaq Composite and S&P 500.

All returns are net of fees and include reinvestment of capital gains & dividends. Past performance does not guarantee future results. Please refer to our Disclosure page for more information about the funds and indexes. Sources: morningstar.com, finance.yahoo.com, 1stock1.com