Retirement & College Savings

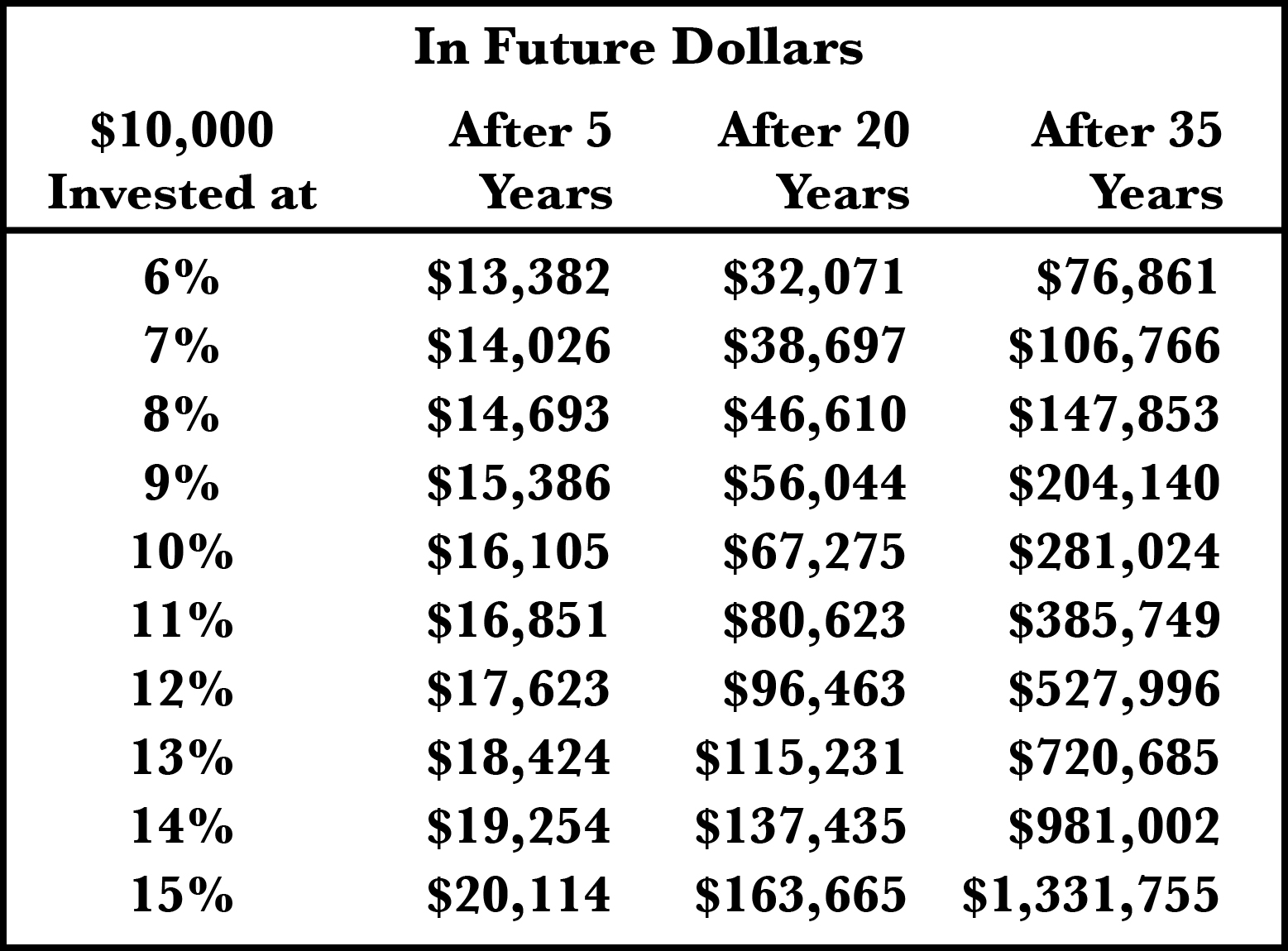

Below is a return table to give you an idea of the long-term effects of the different return rates. Your Investments increase exponentially at the higher return rates of 13% to 15%. It does not represent actual client returns.

Traditional IRA vs. Roth IRA vs. 401K

401K – Returns average 3-8%. Even if employer contribution is matching dollar for dollar, returns are often low and much better options are available.

Traditional IRA – You can contribute up to $6,000 per year or $7,000 if you are age 50 or older. Contribution is tax deductible. At retirement, all distributions are taxable at your ordinary income tax rate.

Roth IRA – Main advantage is if you expect to be taxed at a higher rate during retirement than during your working years.

Sep IRA – If you have your own business you may be able to contribute about 20% of your net earnings up to $61,000 per year.

529 College Savings

Since 2003, according to nysaves.org, NY’s funds’ returns range from 1.6% – 12.3% as of December 31, 2021. Contributions are deductible only on State taxes and gains are not taxable. Better options are available.